Table of content

The Evolving Landscape of Insurance Agencies

The insurance industry is undergoing a period of significant transformation. While the core principles of risk management and client protection remain constant, the way agencies operate is being reshaped by new technologies and customer expectations. Modern insurance agencies face a unique set of challenges that demand innovative solutions.

A. Challenges Faced by Modern Insurance Agencies

Many insurance agencies grapple with manual processes and data silos. Policy information, client details, and communication channels often exist in separate systems, leading to inefficiencies and errors. This fragmented approach makes it difficult to retrieve information quickly, hindering responsiveness and productivity.

Furthermore, inefficient client communication can negatively impact customer satisfaction. In today's digital age, clients expect a seamless and personalized experience. Slow response times, outdated communication methods, and a lack of transparency can lead to frustration and churn.

Finally, managing complex policies can be a burden for agencies. As insurance products become more intricate, with various coverage options and riders, the potential for errors during processing increases. Manual data entry for these complex policies can be time-consuming and prone to mistakes.

The Rise of Automation and Data-Driven Solutions

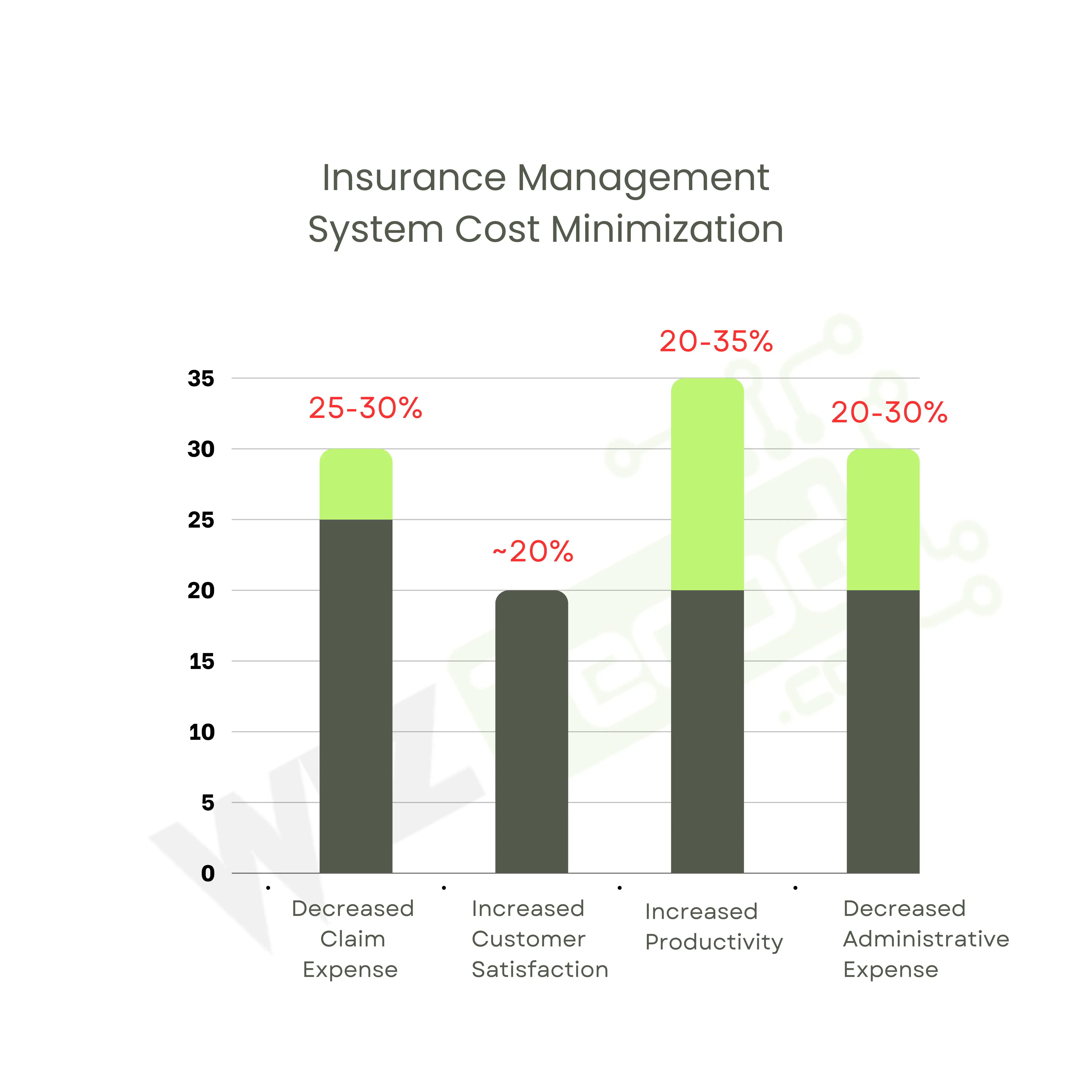

The need for streamlined operations and improved client service is driving the adoption of automation and data-driven solutions in the insurance industry. Insurance Management Systems (IMS) offer a comprehensive solution to address the challenges faced by modern agencies.

The Evolving Landscape of Insurance Agencies

The insurance industry is undergoing a period of significant transformation. While the core principles of risk management and client protection remain constant, the way agencies operate is being reshaped by new technologies and customer expectations. Modern insurance agencies face a unique set of challenges that demand innovative solutions.

A. Challenges Faced by Modern Insurance Agencies

Many insurance agencies grapple with manual processes and data silos. Policy information, client details, and communication channels often exist in separate systems, leading to inefficiencies and errors. This fragmented approach makes it difficult to retrieve information quickly, hindering responsiveness and productivity.

Furthermore, inefficient client communication can negatively impact customer satisfaction. In today's digital age, clients expect a seamless and personalized experience. Slow response times, outdated communication methods, and a lack of transparency can lead to frustration and churn.

Finally, managing complex policies can be a burden for agencies. As insurance products become more intricate, with various coverage options and riders, the potential for errors during processing increases. Manual data entry for these complex policies can be time-consuming and prone to mistakes.

The Rise of Automation and Data-Driven Solutions

The need for streamlined operations and improved client service is driving the adoption of automation and data-driven solutions in the insurance industry. Insurance Management Systems (IMS) offer a comprehensive solution to address the challenges faced by modern agencies.

The Evolving Landscape of Insurance Agencies

The insurance industry is undergoing a period of significant transformation. While the core principles of risk management and client protection remain constant, the way agencies operate is being reshaped by new technologies and customer expectations. Modern insurance agencies face a unique set of challenges that demand innovative solutions.

A. Challenges Faced by Modern Insurance Agencies

Many insurance agencies grapple with manual processes and data silos. Policy information, client details, and communication channels often exist in separate systems, leading to inefficiencies and errors. This fragmented approach makes it difficult to retrieve information quickly, hindering responsiveness and productivity.

Furthermore, inefficient client communication can negatively impact customer satisfaction. In today's digital age, clients expect a seamless and personalized experience. Slow response times, outdated communication methods, and a lack of transparency can lead to frustration and churn.

Finally, managing complex policies can be a burden for agencies. As insurance products become more intricate, with various coverage options and riders, the potential for errors during processing increases. Manual data entry for these complex policies can be time-consuming and prone to mistakes.

The Rise of Automation and Data-Driven Solutions

The need for streamlined operations and improved client service is driving the adoption of automation and data-driven solutions in the insurance industry. Insurance Management Systems (IMS) offer a comprehensive solution to address the challenges faced by modern agencies.

Explore More Topics

Ready to brush up on something new? We have got more to read right this way.

Comments (03)

Allisa Perry

Spetember 15, 2022 AT 07:12 PM

I really enjoyed this post. Very exciting article. It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Show MoreAllisa Perry

Spetember 15, 2022 AT 07:12 PM

I really enjoyed this post. Very exciting article. It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout.

Show MoreLeave A Comment